The anti-Facebook: Snap’s IPO will be the largest in years

The anti-Facebook

Snap’s IPO will be the largest in years

from The Economist

When Snap goes public at an expected valuation of $20bn-25bn its market debut will be the most closely watched since Alibaba floated in 2014

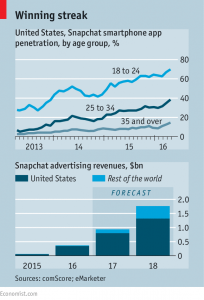

Around 41% of Americans aged 18 to 34 use Snapchat every day, and 150m people globally spend time on it every day

Snapchat is experimenting with new technologies. A large share of people who have used AR will have experienced it on Snapchat

The firm’s IPO prospectus is expected to describe a “camera company”. Its new sunglasses, Spectacles, have caught the attention of analysts

Facebook’s users post permanent records of their lives to a huge circle; Snapchat’s users share impermanent silly images with smaller groups

Snapchat was launched by three students at Stanford University in 2011. It lay undiscovered until high-school girls started using it

Mr Spiegel is good at devising and evolve Snapchat’s features which offer elements of scarcity and urgency that bring people back repeatedly

Snapchat shows users how many snaps they have sent and received since joining, and they try to keep this score high

“Lenses” alters the appearance of users using facial-recognition technology. Snapchat has quietly become the most-used AR product

Snap may need to share more data about its users to target ads. Mr Spiegel has indicated that he may be willing to do this

Snap has started to allow advertising in their apps. It insists on keeping creative control and can veto ads look too much

Though Snapchat’s revenue is far below of Google and Facebook, advertisers certainly welcome an alternative to the Facebook-Google duopoly

Yet there are questions over the high stockmarket valuation. The app has yet to establish strong appeal for older users and emerging markets

Snap is expected to point to high user engagement in Western markets with Snapchat rather than global user growth like Facebook and Twitter

Snap’s profit margins may also disappoint because its ads are not automated like Google but tend to rely on a large human salesforce

Mr Spiegel is secretive like Steve Jobs. No one but Mr Spiegel knows all the important details of the firm’s strategy and future plans

Some early backers also privately express concern that the talent pool behind him is not as experienced as they would like

Last summer Instagram owned by Facebook launched its own “stories” feature. Usage of Snapchat stories has declined significantly since then

The public offering stands as evidence that Snap wants to stay independent. But Mr Spiegel must know Facebook and Google could still buy it

If Snap wants to survive as an independent firm, he may need to make some smart acquisitions by buying, say, a visual search firm