Corporate ambitions

Amazon, the world’s most remarkable firm, is just getting started

from The Economist

Amazon, the former bookseller, is now a leading provider of cloud computing, TV programs and original physical products include Amazon Echo

Since 2015 its share price has jumped by 173%. It’s the fifth-most-valuable firm. But 92% of its value is due to profits expected after 2020

Investors anticipate a rise in sales from $136bn to $500bn (2016-17). It will have to grow faster than any company to justify its valuation

Microsoft has cloud-computing ambitions; Walmart has $500bn revenues & online services. All depends on Bezos. How can he achieve this goal?

Amazon’s unusual approach 1) time: Amazon is resolutely focused on the distant horizon. Mr Bezos emphasises two businesses: e-commerce & AWS

The more customers use Amazon’s services, the more Amazon can invest in new services: two-hour shipping; streaming video and music; Alexa

So long as shareholders retain their faith in this model, Amazon will be able to keep spending, which will keep making it more powerful

2) the breadth of activities: logistics; search engines; SNS; foods; all types of medias. Stockmarkets apply a “conglomerate discount”

Amazon could be a new kind of utility, providing the infrastructure of commerce: AWS; warehouse; air-freight; payment system; drone delivery

For now, Amazon is unlikely to attract the attention of regulators b/c US’s antitrust enforcers look at its effect on consumers & pricing

But Amazon may be accused of using its clout as a digital platform to extend its power to adjacent businesses like Google in Europe

If it become a utility for commerce, the calls will grow for it to be regulated as one, which will bring it into conflict with government

Amazon’s stock price (2001-2017)

| 2017/04/02

| Business, Summary

|

Point, click, treat

The rise of the medical selfie

from The Economist

The right manipulation of light, distance and the angle can make a picture more honest—and therefore more useful for medical purposes

Dip.io uses mobile-phone cameras for urine analysis. The patient takes a picture of dipstick against the background of a colour card

These tests using sticks require colour-matching. Therefore, home analysis is regarded as unreliable

NHS starts to use the app to monitor those suffering from sclerosis. Home-testing will speed up treatment and save NHS around $12m a year

If chronic kidney disease is detected early, by screening the urine of those at risk, sufferers can slow the disease’s progress

For a diagnosis of a skin condition, coloured hexagons act as a reference which the app uses to correct and standardise the resulting image

The app may employ spectroscopy or extend its range into the infrared and ultraviolet, which helps analyse things invisible to the naked eye

| 2017/03/20

| Business, Summary

|

Winner takes all: A slow-motion revolution

Traditional TV’s surprising staying power

from The Economist

You have to wait until a certain hour on a certain day on a certain channel to watch TV. TV is terrifyingly antiquated

People will be able to pick any show at any time from just a few favourite platforms like Netflix or Amazon as well as Facebook and Snapchat

But all this is happening in slow motion, because both distributors and networks have a deeply vested interest in retaining it

Broadcast television is being eroded: 1) billions of people are now watching free videos on SNS supported by targeted advertising

2) Subscription services are amassing big user bases with a low subscription & investing heavily in content, which is strangling a cable TV

In the late C20, the number of channels of cable TV increased as media companies discovered serving niche audiences could generate revenues

Yet as media companies kept adding channels, pay TV hit the limit of the number of channels an average consumer can see in a week: 17

In US the typical pay-TV bill has doubled in a decade, to more than $100 a month, which created an opportunity for internet video providers

US’s viewing of broadcast & cable TV by all age groups fell by 11% & aged 12-24 40% in past 6 yrs. The market penetration: 90% (2010) to 80%

Cord-cutting is beginning in developed markets like US and will damage the cabe TV companies enjoying gross profit margins of 30-60%

Somewhat ironically, TV is now at it’s best because networks (e.g. HBO and FX) and streaming services are competing for subscribers

This competition has given viewers shows that cost $10m an episode and has caused Netflix to pay huge for a third season of Black Mirror

Not everyone will be a winner. Last year 450 original shows were available on US’s TV, more than twice as many as 6 yrs earlier

The $109bn acquisition of Tme Warner would give AT&T vertical integration to protect it if and when the current pay-TV system crumbles

Sports programmes, the last stronghold of the pay-TV oligopoly, accounted for 93 of the 100 broadcasts in 2015, compared with 14 in 2005

Advertising rates in general have been flat or declining in most of the industry, but spending on ads for sports has risen by 50% 2005-2015

The cost of sports rights has been rising. Annually, ESPN is paying $5.5bnr for NFL. ESPN and TNT are paying $24bn for NBA

Investors are asking how long this can go on. ESPN lost millions of subscribers in recent years. The escalating fees will put them off more

For mobile devices streaming rights are sold separately. Telecom companies are likely to offer increasingly large fees to stream sports

The existing business model remains too lucrative to abandon. But eventually fans will watch sports on screens in alternative realities.

| 2017/02/25

| Business, Summary

|

The anti-Facebook

Snap’s IPO will be the largest in years

from The Economist

When Snap goes public at an expected valuation of $20bn-25bn its market debut will be the most closely watched since Alibaba floated in 2014

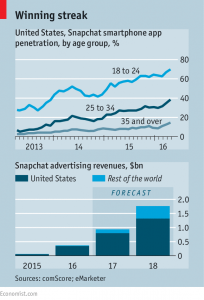

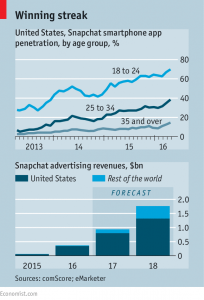

Around 41% of Americans aged 18 to 34 use Snapchat every day, and 150m people globally spend time on it every day

Snapchat is experimenting with new technologies. A large share of people who have used AR will have experienced it on Snapchat

The firm’s IPO prospectus is expected to describe a “camera company”. Its new sunglasses, Spectacles, have caught the attention of analysts

Facebook’s users post permanent records of their lives to a huge circle; Snapchat’s users share impermanent silly images with smaller groups

Snapchat was launched by three students at Stanford University in 2011. It lay undiscovered until high-school girls started using it

Mr Spiegel is good at devising and evolve Snapchat’s features which offer elements of scarcity and urgency that bring people back repeatedly

Snapchat shows users how many snaps they have sent and received since joining, and they try to keep this score high

“Lenses” alters the appearance of users using facial-recognition technology. Snapchat has quietly become the most-used AR product

Snap may need to share more data about its users to target ads. Mr Spiegel has indicated that he may be willing to do this

Snap has started to allow advertising in their apps. It insists on keeping creative control and can veto ads look too much

Though Snapchat’s revenue is far below of Google and Facebook, advertisers certainly welcome an alternative to the Facebook-Google duopoly

Yet there are questions over the high stockmarket valuation. The app has yet to establish strong appeal for older users and emerging markets

Snap is expected to point to high user engagement in Western markets with Snapchat rather than global user growth like Facebook and Twitter

Snap’s profit margins may also disappoint because its ads are not automated like Google but tend to rely on a large human salesforce

Mr Spiegel is secretive like Steve Jobs. No one but Mr Spiegel knows all the important details of the firm’s strategy and future plans

Some early backers also privately express concern that the talent pool behind him is not as experienced as they would like

Last summer Instagram owned by Facebook launched its own “stories” feature. Usage of Snapchat stories has declined significantly since then

The public offering stands as evidence that Snap wants to stay independent. But Mr Spiegel must know Facebook and Google could still buy it

If Snap wants to survive as an independent firm, he may need to make some smart acquisitions by buying, say, a visual search firm

| 2017/02/11

| Business, Summary

|

In retreat

The multinational company is in trouble

from The Economist

Donald Trump dislikes multinationals which are shipping jobs and factories abroad and wants to domesticate them

Mr Trump is aggressively attacking multinational companies, which were already in retreat well before the populist revolts of 2016.

Multinational firms employ only one in 50 of the world’s workers. But a few thousand firms influence what billions of people’s lives.

They boomed in the early 1990s. Investors liked global firms’ economies of scale and efficiency. It was a golden age.

For many companies, global reach has become a burden, not an advantage.

With low tax bills, local firms can steal, copy or displace global firms’ innovations without building costly offices and factories abroad.

Governments want global firms for getting wider supply chains, higher R&D abilities and huge amount of tax revenue.

Too big multinationals should shrink or “localise” their businesses, or become “intangible” to survive.

The retreat of global firms will give politicians a feeling of greater control, but it also will make the value of stockmarkets unstable.

The demise of global firms may make the world seem fairer. But it will mean rising prices, diminishing competition and slowing innovation.

| 2017/02/06

| Business, Summary

|