In a spin

Japan’s government has legalised casinos, but they are not popular

from The Economist

Over ¥23trn ($203bn) is waged annually on pachinko. Pachinko players spend more than the combined betting revenue of all casinos in Macau.

Only 12% of JP citizens supported the legalisation of casinos in Dec. Critics said it would exacerbate problem gambling and attract yakuzas

The construction of casinos could generate ¥5trn in economic activity with another ¥2trn a year from increased tourism.

Foreign casino-operators began lobbying. Bureaucrats are crafting legislation to decide how many resorts to permit and where to put them

Investors fear outbreaks of NIMBYism. In a recent survey 75% of Japanese said they would not like a casino to be built near their homes.

The government wants to double the number of visitors come to JP by 2020, along with the roughly ¥3.5trn that tourists spend annually.

Japan faces regional competition from Macau, Malaysia and Singapore. What will give the country an edge is Japanese culture, or onsen resort

Most Japanese are “emotionally” against casinos and will need to be convinced

| 2017/02/07

| Politics

|

In retreat

The multinational company is in trouble

from The Economist

Donald Trump dislikes multinationals which are shipping jobs and factories abroad and wants to domesticate them

Mr Trump is aggressively attacking multinational companies, which were already in retreat well before the populist revolts of 2016.

Multinational firms employ only one in 50 of the world’s workers. But a few thousand firms influence what billions of people’s lives.

They boomed in the early 1990s. Investors liked global firms’ economies of scale and efficiency. It was a golden age.

For many companies, global reach has become a burden, not an advantage.

With low tax bills, local firms can steal, copy or displace global firms’ innovations without building costly offices and factories abroad.

Governments want global firms for getting wider supply chains, higher R&D abilities and huge amount of tax revenue.

Too big multinationals should shrink or “localise” their businesses, or become “intangible” to survive.

The retreat of global firms will give politicians a feeling of greater control, but it also will make the value of stockmarkets unstable.

The demise of global firms may make the world seem fairer. But it will mean rising prices, diminishing competition and slowing innovation.

| 2017/02/06

| Business, Summary

|

Buttonwood

Industrial policies mean cosseting losers as well as picking winners

from The Economist

Indices in London and New York have reached new highs. But individual stocks and industries have had the odd wobble.

Investors worry that Brexit negotiations, tax laws and trade talks are used as a way to favour some industries and punish others.

The real problem is protecting the position of established corporations—cosseting losers, in other words.

“zombie companies” like Nissan that possess lobbying clout are likely to get protected, which prevents the emergence of more efficient firms

A new paper from OECD finds 3.5% increase in the zombie share is associated with a 1.2% decline in labour productivity across industries.

Zombie firms are discouraging more efficient ones from investing, which causes the decline in new business formation.

EUR is criticised for its inflexibility in the labour market where the difficulty of firing workers makes companies reluctant to hire them

The issue may also help to explain why the productivity performance of the global economy has been so disappointing

If a company makes an investment decision based on a tax break or a presidential tweet, it is not making the efficient use of its capital

A more interventionist government policy is likely to make equities riskier. Who knows which sectors will fall out of favour?

Imagine the reaction of investors if President Bernie Sanders were berating American companies on Twitter, markets would be plunging.

| 2017/02/03

| uncategorized

|

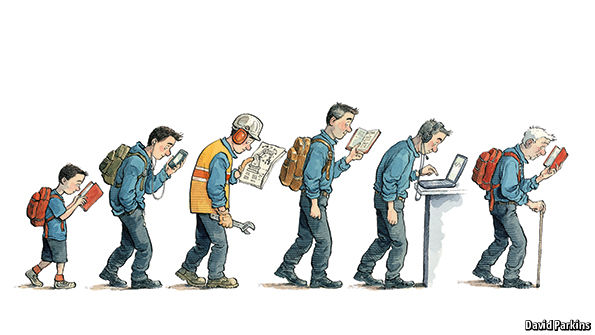

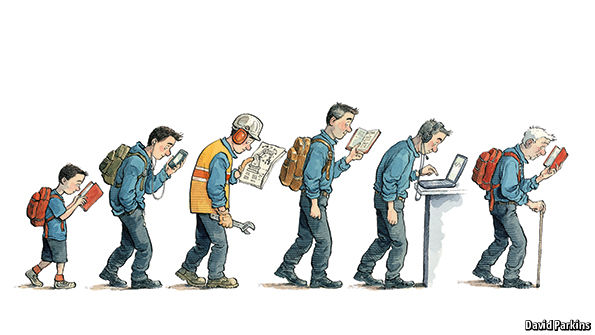

Learning and earning

Equipping people to stay ahead of technological change

from The Economist

The combination of education and innovation led to a remarkable flowering of prosperity.

Working lives are so lengthy and so fast-changing that people must be able to acquire new skills throughout their careers.

The lifelong learning that exists today mainly benefits high achievers and is therefore more likely to exacerbate inequality.

The classic model of education is breaking down. One reason is the need for new and constantly updated skills.

Pushing people into ever-higher levels of formal education at the start of their lives is not the way to cope.

On-the-job training is shrinking. Self-employment is spreading. But taking time out later in life to pursue a qualification is not easy.

Massive open online courses (MOOCs) offer cheap, short programmes that make their students more employable.

Online learning requires some IT literacy, yet one in four adults in the OECD has no or limited experience of computers.

If new ways of learning are to help those who need them most, policymakers should be aiming for something far more radical.

A curriculum needs to teach children how to study and think. Which will make them better at picking up skills later in life.

The biggest change is to make adult learning accessible to all. One way is for citizens to receive vouchers that they can use for training.

Industry can help by steering people towards the skills it wants and by working with MOOCs and colleges to design courses that are relevant.

Governments need to slash the licensing requirements and other barriers that make it hard for newcomers to enter occupations.

To keep the numbers of those left behind to a minimum, all adults must have access to flexible, affordable training.

| 2017/01/25

| Business, Summary

|

A Trump White House

The 45th president

from The Economist

MUCH of the time, politics matters little to most people. Then, suddenly, it matters. Trump’s term stands to be one of those moments.

We know little about what Mr Trump intends. Mr Trump promises to be an entirely new sort of American president. The question is, what sort?

There is evidence from the team he has picked, which includes a mix of wealthy businessmen, generals and Republican activists.

Mr Trump is changeable. But that does not mean that you must always shut out what the president says and wait to see what he does.

Trumpian optimism on display among American businesspeople may deserve to be tempered by fears about trade protection and geopolitics.

After the election, S&P500 index reached record highs, reflecting hopes that Mr Trump’s cutting corporate taxes might lead economic boost.

If his reforms are poorly executed, there is the risk of capital chases that do little to enhance the productive potential of the economy.

Fast rising prices will cause the increase of interest rates. Soaring dollar will harm both emerging countries with dollar debts and US.

Just as Mr Trump underestimates the fragility of the global economic system, so too does he misread geopolitics.

His mistake is to think that countries are like businesses. America cannot walk away from China in search of another superpower to deal with

For as long as Mr Trump is unravelling the order that America created, he is getting his country a terrible deal.

How will Mr Trump’s White House mediated by Mr Trump’s daughter and son-in-law work?

The world is on edge. From the Oval Office, presidents can do a modest amount of good. Sadly, they can also do immense harm.

| 2017/01/24

| Politics

|