Flying high: Are stockmarkets in a bubble?

Flying high

Are stockmarkets in a bubble?

from The Economist

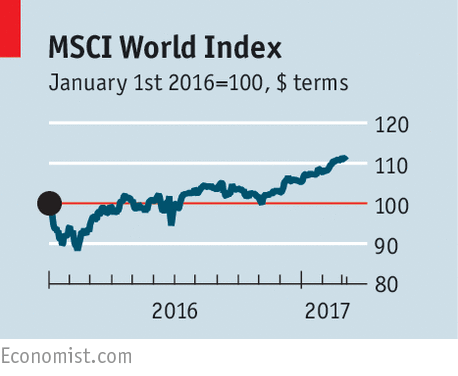

Share prices like the Dow Jones Industrial Average (US), the FTSE 100 (UK) & the MSCI World Index (global) are reaching the ever highest

Soared Snap’s shares & P/E ratio (getting closer to the level of the internet boom & just before 1929) are sending us warning signals

Investors ignore: 1) prosperity comes after a restraint (2015-16); they have more cash from mutual funds & see government bonds unattractive

2) there are indications of a pickup in the global economy after a feeble few years: South Korean exports; commodity prices; European growth

3) expectations for Trump’s tax cuts, infrastructure spending & deregulation; a low oil price may increase profits of S&P 500 by 12% in 2017

– US econ fell in Jan; the recovery is already long; fiscal-stimulus may be weaker; Trump’s immigration policy & trade sanctions harm growth

– FR may raise interest rates in Mar; ECB will decrease bond purchases in Apr; China’s big private-sector credit creation will be tightened

– Populism will be a menace to stock markets because it rejects globalisation. Stocks may fly high for a while, but investors should beware