Free exchange: A new anthology of essays reconsiders Thomas Piketty’s “Capital”

Free exchange

A new anthology of essays reconsiders Thomas Piketty’s “Capital”

from The Economist

Thomas Piketty

Capital in the Twenty-First Century (2013)

– focuses on wealth and income inequality in Europe and the US since the 18th century.

– The central thesis is that inequality is not an accident but rather a feature of capitalism that can be reversed only through state intervention.

– argues that unless capitalism is reformed, the very democratic order will be threatened.

– reached number one on The New York Times bestselling hardcover nonfiction list from 18 May 2014.

– offers a possible remedy: a global tax on wealth.

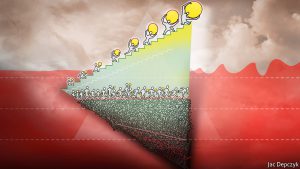

The book’s central thesis is that when the rate of return on capital (r) is greater than the rate of economic growth (g) over the long term, the result is concentration of wealth, and this unequal distribution of wealth causes social and economic instability.

r > g: the rate of return on capital, r, has historically been greater than g, the growth rate of the economy.

Why does this matter?

1) the ratio of an economy’s wealth to its output tends to rise

=> which increases the relative economic power of wealth in society.

2) because the distribution of wealth is usually less equal than the distribution of income, faster growth in wealth than in GDP means a steady increase in inequality.

3) income from capital will grow as a share of income (and income from labour will fall).

So being born rich (or marrying well) becomes a surer route to success than working hard or starting a firm.

=> It is a recipe for social stagnation, and perhaps crisis.

Piketty proposes a global system of progressive wealth taxes to help reduce inequality and avoid the vast majority of wealth coming under the control of a tiny minority.

A trend towards higher inequality was reversed between 1930 and 1975 due to unique circumstances:

– the two world wars,

– the Great Depression

– a debt-fueled recession

=> destroyed much wealth owned by the elite.

=> prompted governments to undertake steps towards redistributing income (especially in the post-World War II period)

The fast, worldwide economic growth of that time

– reduced the importance of inherited wealth in the global economy.

The world today is returning towards “patrimonial capitalism”

– much of the economy is dominated by inherited wealth:

– the power of this economic class is increasing, threatening to create an oligarchy.

Piketty cites novels by

– Honoré de Balzac,

– Jane Austen

– Henry James

=> to describe the rigid class structure based on accumulated capital that existed in England and France in the early 1800s.

Piketty proposes that

– a progressive annual global wealth tax of up to 2%,

– combined with a progressive income tax reaching as high as 80%,

=> would reduce inequality,

=> “politically impossible”

Piketty predicts

– the growth rate will once again fall below the rate of return,

– the twentieth century will be an aberration in terms of inequality.

– Without tax adjustment, economic growth will be lower and inequality will be higher.

– over long periods of time, the average return on investment outpaces productivity-based income by a wide margin.

Piketty dismisses the idea that

– bursts of productivity resulting from technological advances can be relied on to return sustained economic growth;

– “a more just and rational order” to arise based on “caprices of technology,”

– return on investment can increase when technology can be substituted for people.

After Piketty: The Agenda for Economics and Inequality

edited by Heather Boushey, Bradford DeLong and Marshall Steinbaum

– a book by economists, for economists.

Piketty’s Capital lacks some points of view of:

– human capital

– technological change

– the structure of the firm

– the rise in outsourcing

– sexual inequality

– geography

Gareth Jones

– in “Capital” geographical divisions are treated as “container[s] for data”

– it should be treated as arenas with changeable boundaries within which the fight between labour and capital plays out.

Devesh Raval

– Economists think that as wealth accumulates, the return on capital should fall;

– society has less use for the hundredth factory or server than the first.

=> capitalists will seek new, profitable ways to deploy their wealth:

e.g. by investing in machines that can replace labour.

– If firms are good at using their capital to replace labour

(if the elasticity of substitution of capital for labour is greater than one)

then wealth can pile up.

If the return falls a lot as markets struggle to put capital into action,

1) r will decline towards g

2) the ratio of wealth to GDP will eventually stabilise.

=> the elasticity of substitution should be less than one == a well-behaved economy

It may not be.

Suresh Naidu

– a “domesticated Piketty”: communicates in the language of economics

– a “wild Piketty”: pays attention to social norms, political institutions and the exercise of raw power.

– r > g is not a theory to be disproved but a historical fact to be explained.

– the wealthy use their influence to shape laws and society in order to guarantee themselves a better return on their wealth.

The record of the past 40 years is suggestive.

– Top tax rates have fallen,

– financial regulation has weakened (at least before the crisis of 2007-08)

e.g. Dodd–Frank Wall Street Reform and Consumer Protection Act

– companies have found it easier to reduce their obligations to workers.

Economists often praise such moves as enhancing efficiency.

enhancement of efficiency == the wealthy seek to protect their returns at the expense of labour.

A focus on efficiency is unobjectionable in a world in which political and institutional stability can be taken for granted,

Elisabeth Jacobs

– Politics is “everywhere and nowhere” in Mr Piketty’s book

What “After Piketty” reveals

– the message lurking within all the undeveloped arguments in “Capital” about politics and ideology.

Economists should describe how capitalism works even when politics is changing.

It should be difficult but meaningful.